Small Business Fraud Awareness

You take on a wide range of daily tasks, from handling finances to delivering top-notch service. Protect your business from fraud to ensure continued success!

You take on a wide range of daily tasks, from handling finances to delivering top-notch service. Protect your business from fraud to ensure continued success!

Certain individuals take advantage of online marketplace platforms for fraudulent activities, putting users at risk of monetary loss and identity theft.

Living in this modern digital era, our dependency on computers, smartphones, tablets, smart TVs, and constant engagement on social media platforms puts us at risk of cybercriminals looking to exploit and abuse our private data.

Tax scams can happen at any time of year, not just during tax season.

SCAM ALERT: Fraudsters can copy phone numbers, like Magnifi Financial's 888 number. Even though it may appear that Magnifi Financial is calling or texting, do not provide any personal or account information. If you receive suspicious text or email...

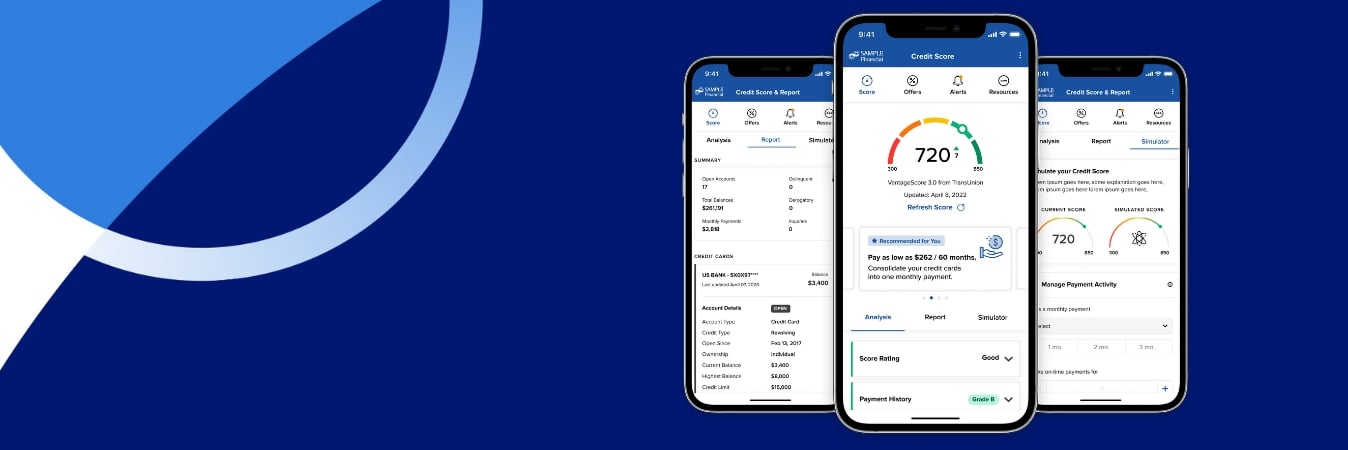

You choose the time and place – we’ll be there. Gone are the days of finding time to run to a branch to make payments or deposit checks. Digital banking has changed how we manage money, providing more effective and efficient tools to meet our...

Scammers are getting smarter and using technology to take advantage of people. Scammers pretend to be from an organization you know and say there is a problem or a prize. They do this to create urgency so you act immediately without time to think.

Zelle® is a fast, safe and easy way to send and receive money with people you trust, like your babysitter, coworkers, fellow PTA mom, or your son’s soccer coach. Whether you just enrolled with Zelle® or have been an active user for a while, there...