You take on a wide range of daily tasks, from handling finances to delivering top-notch service. Protect your business from fraud to ensure continued success!

Fraud is a significant threat to small businesses, but with the right knowledge and proactive measures, you can protect your business from financial and reputational damage.

Understanding Common Fraud Tactics:

Phishing Attacks:

Phishing Attacks:

What It Is: Fraudsters use sneaky emails or messages to trick you into sharing sensitive information like passwords or financial details.

How to Spot It: Look for urgent emails, unfamiliar senders, or suspicious links. Always double-check the legitimacy of the request through a reliable channel.

Invoice Fraud:

Invoice Fraud:

What It Is: Scammers send fake invoices or manipulate legitimate invoices to redirect payments.

How to Spot It: Cross-check all invoices against previous records and confirm any unexpected changes in payment details directly with the vendor.

Business Email Compromise:

Business Email Compromise:

What It Is: Cybercriminals gain access to your email account to impersonate you or key employees and request fraudulent transactions.

How to Spot It: Be cautious of any unexpected requests for wire transfers or sensitive information. Always verify these requests through a secondary communication method.

Identity Theft:

Identity Theft:

What It Is: Fraudsters use stolen personal or business information to commit fraudulent activities or open fake accounts.

How to Spot It: Check your financial statements for unusual activity, and consider using identity theft protection services if necessary.

Effective Prevention Strategies for Small Businesses:

Stay informed, implement robust security practices, and educate your team to stay one step ahead of fraudsters. Remember, prevention is always better than cure, and vigilance is your best defense against fraud.

- Educate employees on recognizing and reporting potential scams.

- Implement robust verification processes for payment changes and sensitive requests.

- Use multi-factor authentication and secure communication channels.

- Maintain up-to-date cybersecurity measures, including anti-phishing solutions.

- Regularly back up data and have an incident response plan in place.

- Avoid clicking on text and email links requesting personal or account information.

The Federal Trade Commission (FTC) assists small business owners in avoiding scams and protecting their data and networks. Visit ftc.gov/smallbusiness for additional resources on preventing scams and enhancing cybersecurity.

Fraud Management with Positive Pay

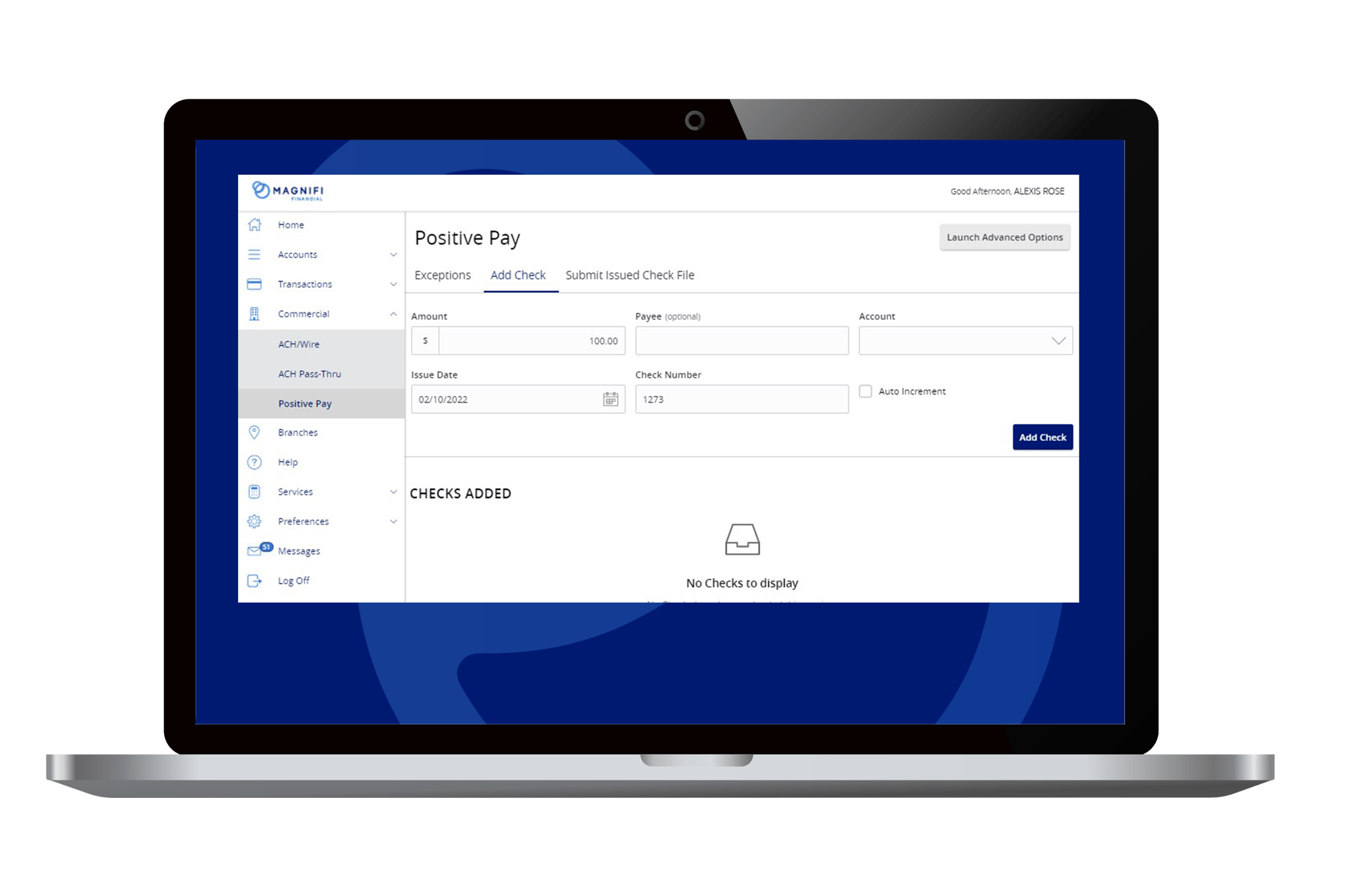

Magnifi Financial’s Fraud Management with Positive Pay service is a simple yet powerful fraud prevention tool that focuses on the transaction management needs of business members.

This service allows business owners to detect fraud in real-time and reject suspicious or unapproved payments. Faster detection means less chance for liability for those charges. Businesses of all sizes and types can benefit from this fraud detection and prevention service.

- Submit your check or ACH information in Magnifi's digital banking.

- As each item clears, it's verified in the check number, amount paid, and date issued.

- Receive a notification when a payment does not match your records.

- Review and decide whether to pay or reject each flagged payment.

Magnifi offers products and services to help safeguard your business; call our Business VIP Line at (833) 267-7321 to learn more. We'll work together to secure your business's finances and ensure your focus remains on what truly matters—growing your business.

Watch this video to learn more about Business Email Compromise (BEC).